Rockaway Ventures Strengthens German Footprint with Investment in Startup Raus

Raus has become the fourth German startup in the current portfolio of Rockaway Ventures, joining Apaleo, a cloud platform for the hotel industry, Freeway Camper, which specializes in motorhome rentals, and Vivere, a company providing comprehensive e-commerce services. Raus, the newest addition to the portfolio, brings an innovative approach to recreational accommodation with its network of portable and sustainable living units that can be easily installed in various locations.

Raus addresses the rapidly growing demand for flexible and eco-friendly nature stays, offering an escape from urban life. In the investment round led by ROCH Ventures, Raus raised €8.5 million, with participation from Rockaway Ventures, Speedinvest, 10x Founders, and others. As part of the investment, Raus secured an asset-backed loan from Germany’s Varengold Bank, which marks a significant step toward expanding its growth, strengthening its position in Germany, developing its online platform, innovating products, and, notably, pursuing geographic expansion across Europe, beginning in neighboring Austria in the coming weeks.

The expansion into Austria coincides with the launch of the new Cabin 2.0 model, which features a lighter and more compact design. In 2024, Raus aims to consolidate its presence in Germany, establish more community locations, enhance its proprietary technology for seamless stays, and expand its platform with additional products and services.

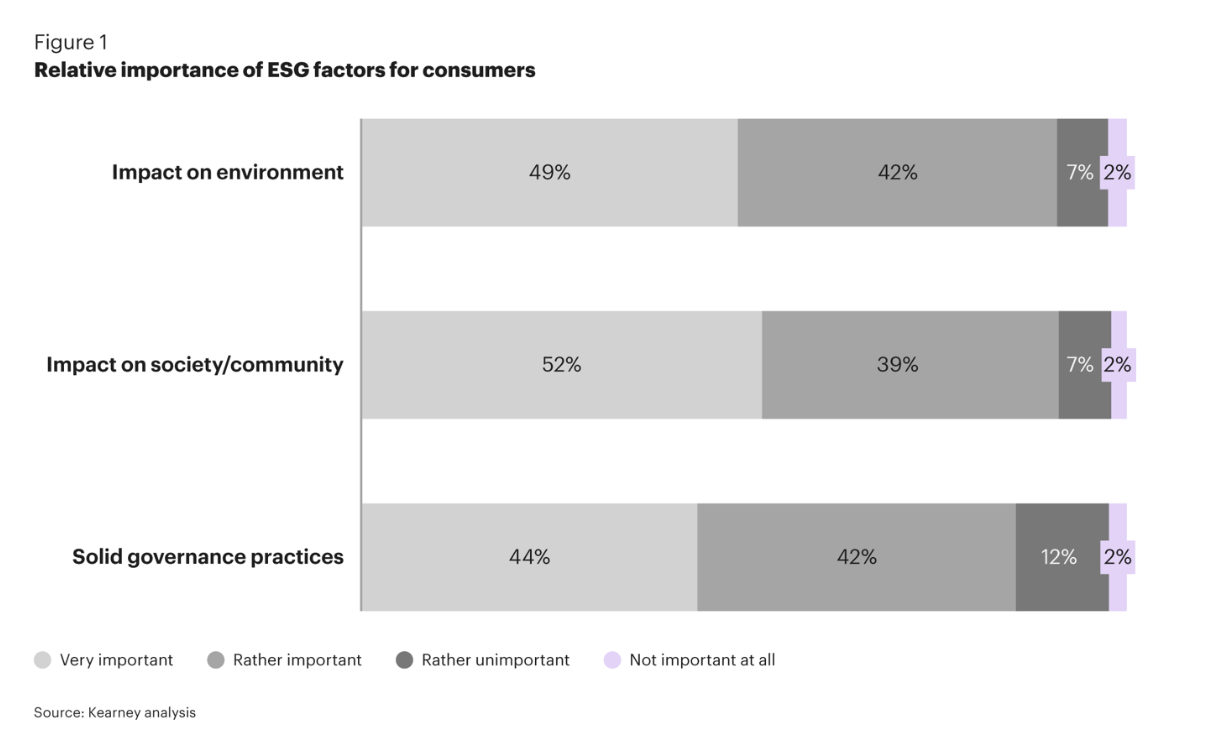

“We are extremely grateful for the support and trust of our investors in our business model and vision. With Raus, we are addressing critical challenges in the travel industry, meeting the ongoing demand for responsibility and sustainability, which will continue to be important for many years to come,” says Julian Trautwein, co-founder and CEO of Raus.

In the past year, Raus experienced a 500% year-on-year increase in revenue, a fivefold increase in guest numbers compared to the previous year, and a tripling in new bookings, demonstrating a sustained demand. Additionally, through close collaboration with farmers and foresters, Raus has positively impacted agricultural businesses, providing local partners with an average additional income of €1,500 per month.

“Raus has an exceptionally experienced and talented team that has succeeded in taking a leading position in a newly emerging vertical in the tourism and housing market. This is an area where we see long-term potential for innovation and growth. For Rockaway Ventures, this is another significant step as we continue to expand our portfolio in the dynamically developing German startup ecosystem with a company that has strong potential for geographic expansion,” explains Dušan Zábrodský, General Partner at Rockaway Ventures.