Embracing ESG principles is going beyond short-term financial gain

ESG has been with us for a while now. It has been slowly gaining momentum since the principles (Environmental, Social and Governance) were first mandated in financial evaluations through the 2006 United Nations’ PRI report. Initially, 63 investment firms with $6.5 trillion AUM signed on, growing to 2450 signatories representing over $80 trillion AUM by June 2019. While traditionally associated with large corporations, ESG considerations are now extending their reach into the realm of startups.

Success of a startup is no longer solely determined by financial performance as founders are expected to adjust to a dynamic and quickly evolving world. The path to achieve quantifiable value now leads through recognizing ESG factors at the core of business operations. Of course, not all ESG factors are applicable to your business, so you have to find the ones that do. Nevertheless, taking this approach will ensure long-term resilience and viability. In this blog post I will try to explain why I believe having ESG factors incorporated in your startup is beneficial and how Rockaway Ventures incorporated ESG into its mindset.

What are the benefits of ESG factors for your Startup

Prioritizing ESG from the outset expands your potential investor pool and significantly increases the likelihood of securing investment support. Angel investors as well as VC funds now assess these factors more than ever. This shift is driven by the growing influence of ESG practices on market benchmarks and financial performance. Additionally, meeting ESG standards becomes imperative for investments from development finance institutions (DFIs), and impact investors specifically seek out businesses with ESG factors in mind.

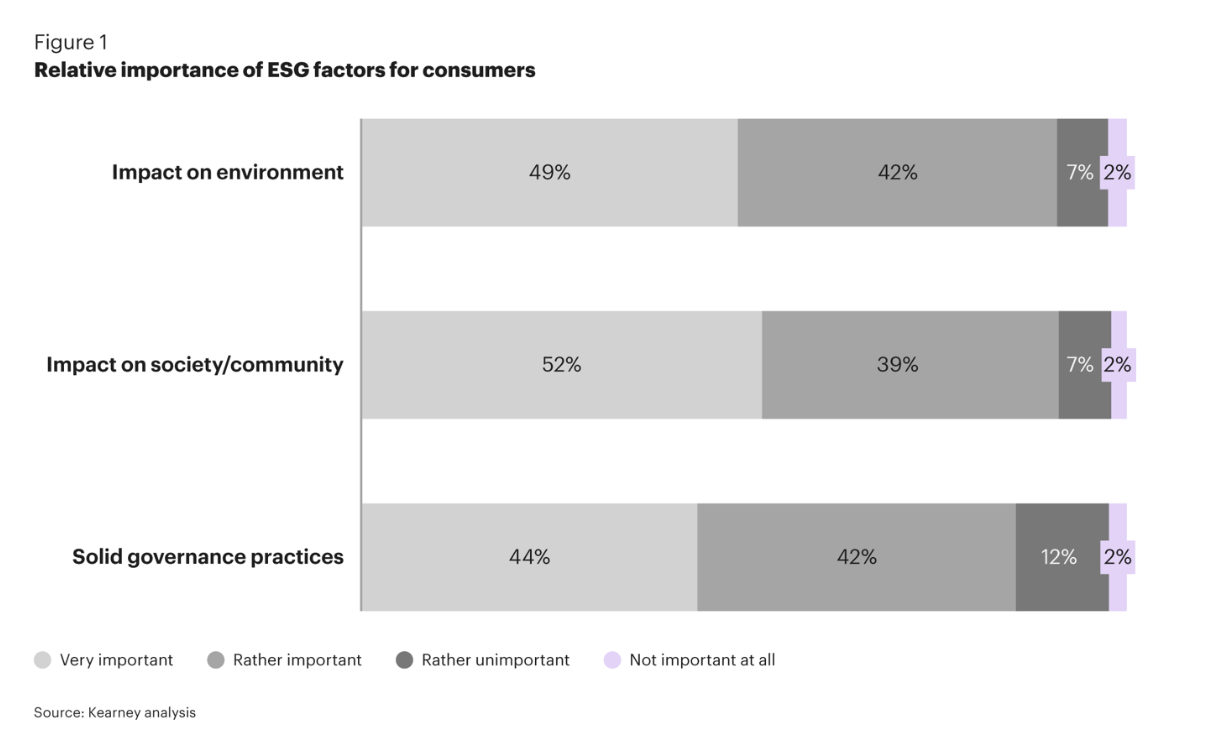

A recent study from Karney found that roughly half of the consumers in Central and Eastern Europe (CEE), about 49 percent, consider ESG factors to be highly important, while an additional 40 percent view them as moderately important.

Ignoring ESG practices can lead to missed opportunities. Although it is challenging for resource-constrained startups, investing in ESG pays off when consumers and investors recognize your responsible approach.

ESG practices can also play a decisive role in the process of building trust, particularly when startups lack an established reputation and showcasing your corporate responsibility through ESG reporting can foster trust among internal and external stakeholders. Highlighting your focus on sustainability helps instill confidence when pitching to VC’s or investors as they often value transparency and a long-term commitment to the company’s success.

What does ESG factors mean for startup investing

Integrating ESG factors into startup investing means that the fund has to understand clearly what ESG is about and try to implement and integrate as many ESG factors as possible into their own policy to be able understand the complexity and importance of each of the metrics, to evaluate the investees based on clear process and to lead startups throughout the entire lifecycle. Today, startup investment demands a whole new approach within due diligence integrating exclusionary screenings, positive screenings and where possible also detailed impact of the environmental factors.

Even though such a process is hardly applicable on startups at pre-seed or seed stage having 5 or 20 employees focused on different problems it’s clear that this approach starting with always on ESG education of the startups, considering ESG factors throughout the evaluation process has an important impact and drives a mindset change. It is obvious to corporations and bigger companies already that this approach goes beyond short – term financial gain. It embraces the idea that responsible and sustainable practices incorporated in the business lead to financial savings, better product outcomes and overall more sustainable future and this applies to startups and investors as well.

By Kateřina Havrlant, Operating Partner of Rockaway Ventures Fund